- Annual Dividend of Over KRW 5,000 per Share…ensuring stable returns despite an uncertain business climate

- Plans to Repurchase and Retire Treasury Shares Equal to 1-2% of Market Cap or Offer Additional Dividends…expanding shareholder returns to meet market demands

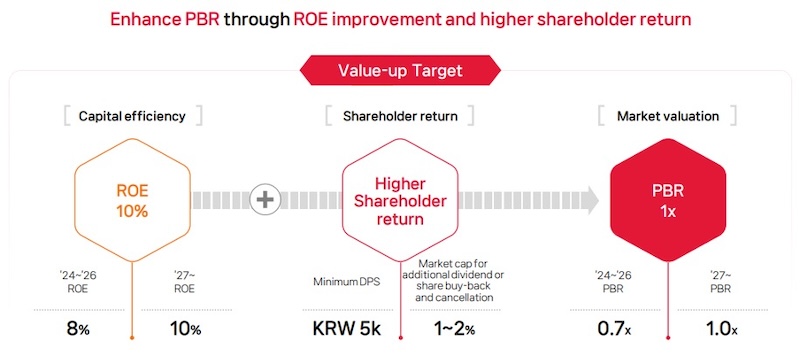

- Targeting a 1x PBR by 2027 through portfolio rebalancing, strengthening financial stability, and improving operational efficiency

SK Inc. announced plans to enhance the stability and scale of shareholder returns, targeting corporate value growth through portfolio rebalancing, strengthening financial resilience, and improving operational efficiency.

On the 28th, SK Inc. disclosed its 'Value-Up Plan,' centered on enhancing corporate value. This marks the first disclosure of its kind by a Korean non-financial holding company, including an English version to improve accessibility for foreign investors.

SK Inc. also emphasized its upgraded shareholder return policy as a key priority.

The company has established a minimum dividend of KRW 5,000 per share (based on common stock) to ensure dividend stability, regardless of business performance or fluctuations in regular dividend income, equating to a minimum annual dividend commitment of approximately KRW 280 billion.

Additionally, SK Inc. is expanding shareholder return opportunities by leveraging gains from asset sales and special dividend income generated through portfolio rebalancing efforts initiated earlier this year. These funds may be used to repurchase and retire treasury shares equal to 1-2% of market capitalization or to provide additional dividends. Previously, SK Inc. distributed special dividends from investments gains, such as the 2021 IPO of SK Biopharmaceuticals and the partial sale of its stake in logistics company ESR in 2022.

“The recent upgrade to our shareholder return policy has improved both the predictability and scale of shareholder returns compared to our 2022 plan, which included a cash dividend payout exceeding 30% of recurring dividend income, as well as the repurchase and retirement of over 1% of the company’s market capitalization,” an official at SK Inc. explained.

SK Inc. is accelerating efforts to strengthen group-level competitiveness through portfolio rebalancing, enhancing financial soundness, and improving operational efficiency, with a long-term goal to increase Return on Equity (ROE) to approximately 10%. ROE is a key metric reflecting the profit a company generates relative to the capital invested.

In particular, SK Inc. plans to continue supporting its subsidiaries in business model innovations, product and technology differentiation, and process optimization to enhance profitability actively.

Meanwhile, SK Inc. aims to strengthen its portfolio by internalizing high-quality assets and maximizing synergies, while securing capital for future growth areas·such as artificial intelligence (AI) and integrated energy solutions·through active asset monetization. These initiatives are expected to significantly improve the company’s financial structure.

This year, SK Inc. is planning to integrate SK Innovation and SK E&S, as well as SK Ecoplant with SK Materials Airplus and Essencore. Additionally, the company is advancing with the sale of SK Specialty.

With this upgraded shareholder return policy and enhanced capital efficiency, SK Inc. aims to achieve a Price-to-Book Ratio (PBR) of 1x by 2027, doubling the five-year average PBR (0.5x) of Korean holding companies. PBR, calculated by dividing market capitalization by net asset value, reflects the stock price relative to the company's book value.

An SK Inc. representative added, "This Value-Up Plan disclose includes as many concrete details as possible regarding SK Inc.'s strategy to enhance corporate value. We are committed to listening closely to shareholder feedback and actively sharing results, working to deliver corporate value that exceeds market expectations."

[Reference] Key Highlights of SK Inc.’s Value-Up Plan